How Physicswallah escaped the startup math of giving everything away

Alakh Pandey kept control while rivals surrendered it. Here’s why public markets will now test his capital-heavy pivot

Alakh Pandey kept control while rivals surrendered it. Here’s why public markets will now test his capital-heavy pivot

The VC firm will likely rake in billions from long-awaited IPOs. But just as the wins roll in, top partners are walking out, internal tensions are mounting, and its global AI ambitions are raising more questions than answers

The hyperbole that secured the entrepreneur a storied exit from Whitehat Jr may not serve him well for coaching cancer patients

Wealthy parents ditched Indian exam boards for international ones, but now they want more: un-classrooms

To prioritise corporate governance and financial management, VCs like Peak XV, Matrix, and Accel are exercising a lot more oversight, introspection, and prudence while signing deals with Indian startup founders

Unacademy changes its own DNA for its offline centres to do well to survive the edtech downturn

From bean counting, the new finance leaders are now forming company strategies and driving major decisions. But at the cost of innovation

He put a 40-year legacy at India’s top lender on the line to “rescue” Byju’s, Oyo, Bharatpe, and many upstarts. And he is loving it

Byju’s wanted to make the most of its billion-dollar acquisition of Aakash. But the selling hacks drove a wedge between the two teams on the ground

Where have all the brand mascots gone?

As if working for the troubled edtech major wasn’t bad enough, its employees are struggling to overcome Byju’s stigma in the job market

Indian non-banks worsen the edtech giant’s woes by no longer funding its users. And, the company’s FY22 revenue is less than the Rs 10,000 crore (US$1.2 billion) touted by Byju Raveendran

It's risking the business it has built for the one that it wants to build

Classplus is betting on Abhinay Sharma—a popular YouTube-Unacademy teacher—despite fierce competition in the government test-prep market. And replicating success stories like Physicswallah's Alakh Pandey may prove to be a daunting challenge

Amid edtech struggles, GUVI and Vidyakul have attracted investors with courses in local languages. But even with government initiatives working in their favour, they have to contend with slim margins

The fair value of a two-year-old startup Jar’s equity share zoomed 8,000% in 17 months. DealShare, Byju’s, Cred and many others saw similar crazy spikes. Backed-up by fantastical assumptions in reports of valuers appointed by the startups themselves. It was a wild party. Until it lasted.

There’s a lot more to them than the nearly flat revenue and the 15X spike in losses

With slowing growth and a funding crunch, edtechs like Unacademy and Vedantu have made tutors their new sales force. But the pressure to create viral videos and the fear of not meeting targets are too much to handle for many

With the Common University Entrance Test presenting new opportunities for Byju’s, Unacademy and their offline peers, some schools are facing an existential crisis of sorts. Amid the chaos, students are paying a high price

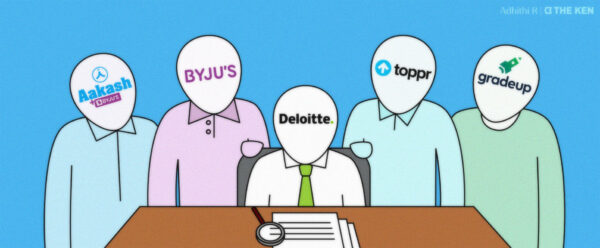

Deloitte, which audits Byju’s, hasn’t yet signed off on the edtech’s 2021 financials—its reticence comes from the lending and accounting decisions that Byju’s has made. The impact of this decision will ripple across India’s startup sector

The US$300 million acquisition of WhiteHat Jr in 2020 was supposed to be Byju’s’ international expansion engine. Nearly two years later, the coding-for-kids platform, which added a maths division in 2021, is a shadow of its former self

For a long time, coding in edtech has been synonymous with WhiteHat Jr in India. A handful of smaller companies like CuriousJr, Coding Ninjas, StayQrious are trying to break through and they’re doing it by focussing on markets where accessibility to tech and coding is nearly non-existent. To succeed, they’ll need to recalibrate the very nature of coding edtech

Quizizz grew from an idea to over 75 million users in six years, zero marketing spend and with only 20 engineers. After taking the US by storm despite no paid advertising, the Bengaluru-based startup is now turning its gaze to emerging economies. But its homeland, India, could be its biggest challenge yet

Amazon Academy has been discreetly building a foundation in India’s online test prep market since last January, with over one million registered users already. But even after onboarding reputed teachers and partnering with traditional coaching institutes, the venture seems to be missing some key ingredients

Byju’s big bang entry into the public sector comes via a headline-making partnership with NITI Aayog that promises free educational resources. But without inputs from on-ground stakeholders, the programme is seeing a serious mismatch between Byju’s content offerings and the realities of a post-pandemic learning gap

Since acquiring Embibe in 2018, Reliance has spent nearly $80 million revamping the AI-based edtech. With a mega relaunch lined up for January 2022, Embibe is looking to take the quickest route to scale—schools

The four-year-old partnership with Disney was meant to spearhead the overseas expansion of Byju’s. However, the clash between the Byju’s hare and the Disney tortoise resulted in a confused offering that catered neither to Indian or overseas markets. Now, Byju’s has placed its bets on a new hope

Newly crowned India’s most-valuable startup, Byju’s has scooped up nine companies in its 10-year run. There’s three more in the works. Despite slim share pickings, the Byju’s umbrella is looking more and more appealing for edtech founders

The playbook behind Tiger Global’s recent spate of investments is both familiar and different from its initial foray in India when it backed now-iconic companies such as Flipkart and Freshworks. But where it pioneered a change in India's VC landscape last time, it is evoking fear, panic and greed in the startup ecosystem this time around.

India's edtechs had a breakout year in 2020. Byju's now boasts over 70 million users, while Unacademy entered unicorn territory. What these edtech behemoths haven't done, though, is go beyond India's privileged students or prove their efficacy. Now, a patchwork of non-profits is working with state governments to take e-learning to the masses, while also proving their methods work

Byju’s roster of products now stretches from interactive games for preschoolers to test-prep packages for competitive exams, made possible by a litany of acquisitions. But even as the decacorn makes a beeline for western frontiers, it still hasn’t cracked product-market fit

Two individuals from two different walks of life have challenged the prowess of edtech giants Byju’s and WhiteHat Jr. But a system of strategic social media takedowns—of posts and people—threatens their right to dissent and criticise

SoftBank’s investment in Unacademy is novel for multiple reasons. It marks the firm’s first bet on an Indian edtech, a break from its preference for market leaders, and could finally create genuine competition for the Byju’s juggernaut

Chinese VCs and tech companies like Shunwei, Fosun, Tencent and ByteDance want a piece of India’s rapidly growing edtech market. And they’re offering not just money but also strategic inputs and insights from their home market

In FY 2019, Doubtnut had revenues of just over $23,000. A little over a year later, it is being acquired by Byju's for $100 million. What made Byju's splash the cash?

From Educomp at the turn of the decade to Byju’s today, India’s edtech scene has changed tracks. As companies target every level of learning, even offline players are waking up to the digital wave engulfing them

Venture capitalists often let their investments do the talking. And talk they do. From $100-million Series A rounds to $500+ million funding rounds, India has had enough and more investor interest and shifting investment patterns of late. We decided to map that interest with data from the last three years

Aakash, the brick-and-mortar coaching behemoth that controls 5% of the $6.6 billion offline coaching market, wants almost 25% of its business to be digital by 2023. How it deals with building this new tech empire—through talent, tech and content—will determine its legacy

Unlike full-stack edtech players like Byju’s, platforms like Doubtnut and Brainly are hoping to turn doubt solving into a standalone business. With millions of users and millions in funding, can they succeed where platforms like Hashlearn and Toppr stumbled